City Hall Hours

Monday - Thursday: 8:00 am to 6:00 pm

Friday: 8:00 am to 12:00 pm

Advisory Board Meetings

-

City Commission Meeting

March 2, 2026

Posted February 27, 2026

[Agenda ›]

[Full Packet ›]

Citizens who wish to speak must sign the Public Comment Registration Form located in the Commission Chamber prior to the beginning of the meeting.

The meeting can be viewed online by visiting the [Meetings Portal]

-

Library Board Meeting

March 4, 2026

Posted February 27, 2026

[Agenda ›]

Please enjoy this New Year's Message from City Manager Manny Gomez!

Please click [here] to view the schedule for the 2026 Rockwind Community Links tournament.

The City of Hobbs is deeply honored to receive this recognition from Hobbs Municipal Schools. Being acknowledged by a partner so dedicated to the growth and success of our community is both humbling and inspiring. This expression of appreciation reinforces the shared values that guide our work and strengthens our commitment to supporting the students, families, and educators who make Hobbs exceptional.

Please [click here] to view the letter.

The City of Hobbs is excited to be developing the "Veterans Path of Freedom" at the Veterans Memorial Park to honor veterans, past and present. If you are a veteran, or know a veteran, who would like to have their name on a brick, please submit this application form along with a proof of service and residency.

The online application can be found by [clicking here]

A printable version of the form can be found [here]

The Recreation Department has put together an excellent and informative annual report, highlighting the many great events and achievements of 2024! View it here!

Opened in 2015, Rockwind Community Links, is a 27-hole golf facility owned and operated by the City of Hobbs.

Rockwind provides the citizens of Hobbs an amenity like no other in the country. The award-winning facility includes a championship 18-hole course, a 9-hole par-3 course, a dual ended practice range and multiple short game areas for practice and learning.

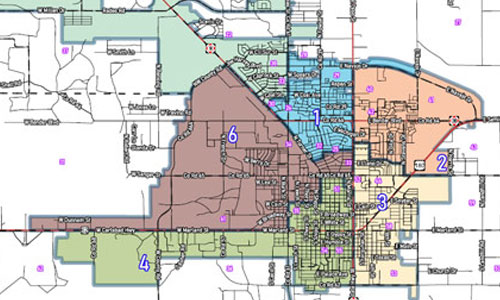

On December 6, 2021, the Hobbs City Commission voted to adopt a new designation of City Districts.

To view the newly adopted Rules and Meeting Procedures for City Commission meetings, please click the following link:

The South Hobbs Convenience and Recycle Center is open Thursday, Friday, Saturday, and Sunday from 8:00 am to 5:00 pm.

Click the following link for more information.

If you’re operating a business for profit in Hobbs, you must have a gross receipts tax identification number and a City of Hobbs’ business registration.

In an effort to educate the public about the laws of the City, we are providing the following information regarding the most common types of licenses needed to conduct business within the City. If you have specific questions about what type of license is required for you, please contact City Hall at 397-9200.

State Law - Gross Receipts Tax Identification Number

All persons engaging in business in New Mexico must register with the New Mexico Taxation and Revenue Department to obtain a "Combined Reporting System" (CRS) identification number. The CRS is the Department’s method for reporting the state’s major business taxes: gross receipts tax, all local option gross receipts taxes, compensating tax, and withholding tax. The CRS identification number is your state tax identification number and is commonly called the gross receipts tax identification number.

There is no fee to obtain a CRS identification number. There are two ways to obtain a CRS identification number. The first way to obtain a CRS identification number is to submit an application to the local tax office in Roswell in person, by mail or fax and you may expect to receive your CRS identification number within one week. The second way to obtain a CRS identification number is to apply online. Online registration is available at: https://tap.state.nm.us/tap. A CRS identification number will be automatically generated once registration is complete.

Gross Receipts Tax Rate

The gross receipts tax rate for persons engaging in business from a physical location within the Hobbs City Limits is 6.8125%. Even if your business is providing goods or services outside the City Limits or County Limits, if you are a Hobbs-based business, you must charge sales tax and remit those taxes to the State.

Business Registration - New Merchandise, Sales, Service

Each place of business with an actual physical address located within the Hobbs City Limits, operating a business for the purpose of profit and who are required to have a New Mexico taxpayer identification number, are required to obtain a City of Hobbs Business Registration. The annual cost is $25 per calendar year. (Chapter 5.04 of the Hobbs Municipal Code)

Mobile Business Registration - New Merchandise

Any person who has a valid business registration within the City of Hobbs and is engaged in mobile business activity at a location which is not their usual place of business must pay an additional $100.00 and obtain a Mobile Business Registration. The annual cost is $100.00 per calendar year. (Chapter 5.04.031 of the Hobbs Municipal Code)

Secondhand Dealer’s License - Used Merchandise

Any person operating a secondhand store or junkshop within the Hobbs City Limits, engaging in the business of buying and reselling used merchandise or goods, is required to obtain a New Mexico gross receipts tax number and a City of Hobbs Secondhand Dealer’s License. The annual cost is $50 per year. (Chapter 5.32 of the Hobbs Municipal Code)

Solicitor's Permit

A solicitor’s license is required for any person who goes from door to door visiting single family or multi-family dwellings and businesses to sell any goods, wares, merchandise or services. The annual fee is $25.00 and fingerprinting is required along with a background check and approval by the Police Chief. All approved solicitors are required to visibly display their valid Solicitor’s Permit issued by the Hobbs City Clerk’s Office which will include a photograph of the solicitor. (Chapter 5.36.010 of the Hobbs Municipal Code)

*PENALTY*

Any person convicted of a violation of any provision of the above chapters of the Hobbs Municipal Code shall be guilty of a misdemeanor and shall be punished by a fine of not more than $500.00 or by imprisonment for not more than 90 days, or by both such fine and imprisonment. Each day that the violation is committed or permitted to continue shall constitute a separate offense and shall be punishable as such hereunder.

Tune in to 90.7 FM hear the latest public service announcements, event updates and emergency broadcasts from the City of Hobbs, 24 hours a day!

The City Commission meetings are now broadcasted LIVE on KHBX 90.7!

Use Code RED to be notified by your local emergency response team in the event of emergency situations or critical community alerts (such as temporary trash pickup changes). Sign up for the text, call, and email service by clicking here.

You can download the mobile app here:

Our Mission is S.E.R.V.I.C.E.

Engaged Team Members

Responsive

Visionary

Inclusive

Customer Driven

Enhance Quality of Life